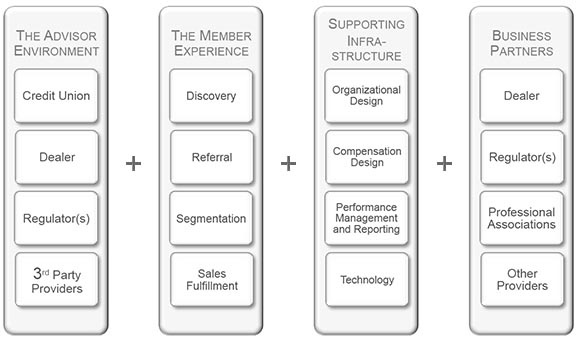

The architecture of a successful Wealth Management delivery model rests on four foundational pillars; the Advisor Environment, the Member Experience, the Supporting Infrastructure, and the selection of key Business Partners.

Summary of the strategic contribution of each of these components.

Encompasses the personal, professional, and member-facing dimensions of the Advisor experience. An enabling environment supports the growth of sizeable, sustainable books of business, deepens member relationships, and enhances the development, attraction, and retention of top-tier Advisors.

Captures the full member journey—from first contact through product selection and ongoing relationship management. A well-designed experience ensures seamless sales fulfillment across all channels and strengthens member relationships by increasing share of wallet and positioning the Credit Union as the provider of choice.

Defines and operationalizes the Advisor environment, embedding the Member experience, and providing the systems, oversight, and controls necessary for effective management and sustainable performance.

External entities—including dealer partners, regulatory bodies, licensing agencies, and other service providers—play a critical enabling role. Thoughtful selection and alignment of these partners with the Credit Union’s value proposition are essential to the success of the overall wealth management strategy.